The Trans-Pacific Partnership (TPP) is the largest regional trade accord in history. Encompassing one-third of the worlds trade, the TPP agreement, which requires the approval of Congress, has become a flashpoint in the U S presidential campaign; opposed by both 2016 major party candidates (Trump & Clinton) as a symbol of failed globalism and the loss of U S jobs abroad.

If you’re like most Americans though, you keep hearing about the TPP, but in truth, only have a vague idea of what it really is— well, there’s good reason. The negotiations were actually a closely guarded secret, and those partaking in the negotiations didn’t want us to know what it entailed until it was too late to change it. So you might say the scariest part of TPP is that no one really knows what’s in it.

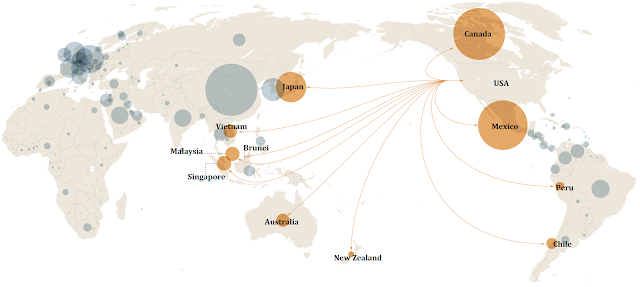

The countries involved include: Australia, Peru, Malaysia, Vietnam, New Zealand, Chile, Singapore, Canada, Mexico, the US, Japan, and the nation of Brunei— pronounced: “broo-nye” . . . the Southeast Asian nation Forbes ranked as the fifth-richest in the world, based upon the country’s petroleum and natural gas fields.

In a nut-shell, the TPP is a free trading arrangement that will eliminate over 18,000 taxes the various participating countries put on “Made-in-America” products. It’s actually a huge trading agreement, which will, if approved by Congress, eliminate tariffs on goods and services and harmonize various regulations between the partner countries. If the TPP agreement goes through, it will affect more than 40% of the imports and exports of the United States. It should be noted that the United States already has Free Trade Agreements in force with six (6) of the TPP participants: Australia, Peru, Chile, Singapore, Canada, and Mexico.

As recently as 2014, the US broke the record in exports for the fifth (5th) year in a row, by selling $2.34 Trillion in goods and services overseas. And here’s why that’s important: The more we sell abroad, the more jobs we support here at home, and too, those jobs tend to pay American workers better; actually, companies that export pay as much as 18% more than companies that don’t.

The TPP seeks to closely bind Pacific nations and others through lowering tariffs while also serving to reduce China’s growing regional influence. In fact, the provisions deliberately exclude China, so when everyone officially signs the agreement, Chinese goods could go from the cheapest to the most expensive and because most financial experts believe their entire economy is based on exports; yep, in theory at least, the entire Chinese economy may be at risk.

An 800+ page study released in June of 2016 by the United States International Trade Commission forecasts the TPP’s Likely Impact on the U.S. Economy:

“The overall impact of the TPP Agreement would be small as a percentage of the overall size of the U.S. economy; it would be stronger with respect to countries with which the United States does not already have a free trade agreement (FTA) in force: Brunei, Japan, Malaysia, New Zealand, and Vietnam.” . . . pg. 22 . . . [Note: The United States already has Free Trade Agreements (FTAs) in force with Australia, Canada, Chile, Mexico, Peru, and Singapore — all of which are TPP participants]

“The Commission estimates that by 2032, U.S. real GDP would be $42.7 billion (or 0.15 percent) higher than a baseline scenario that reflects expected global economic conditions without TPP. Real income, a measure of economic welfare that measures consumers’ purchasing power, would be $57.3 billion higher (or 0.23 percent) over the same time period. Employment would be 0.07 percent higher, or close to 128,000 full-time equivalents. These gains would be slightly higher after 30 years (that is, 2047), when all provisions of the agreement would be in force. By 2047, real GDP (Gross domestic product) would rise by $67 billion (0.18 percent); real income, by $82.5 billion (0.28 percent); and employment, by 0.09 percent, or nearly 174,000 full-time equivalents, compared to the baseline.” . . . Pgs. 22 & 23 . . .

Within the text of the two above paragraphs, the extensive study by the U S International Trade Commission clearly demonstrates that the Commission took the potential impact of the TPP with a “long term” view and the overall impact of the TPP Agreement will truly be trivial in the long run.

Then, why are so many people against the TPP?

One of the most fundamental objections is that the public has a right to know fully what it involves, just as our elected legislators have the right and responsibility to provide oversight.

One of the most fundamental objections is that the public has a right to know fully what it involves, just as our elected legislators have the right and responsibility to provide oversight.

The Trade Commission offered no defense on this charge, but it’s difficult at best to argue otherwise.

It is often maintained that TPP will reduce environmental safeguards. Its environmental guidelines are all voluntary and proposed mechanisms for resolving ecological disputes are non-binding. On the other hand, the TPP Trade Commission report states on page 484 that the Agreement actually goes further than any other major trade agreement in addressing environmental concerns.

Most economists agree that NAFTA was responsible for considerable domestic job losses; the TPP is expected to continue that trend, just as the government is touting a rejuvenated manufacturing sector. The Trade Commission report suggests otherwise in regard to continuing the trend, as is referenced 3 paragraphs above in orange colored text, the terms “overall impact would be small” and “employment would be higher” can be confirmed on pages 22 & 23 of the Report.

Some folks contend that the internet would change dramatically in that TPP could turn Internet Service Providers (ISP’s) into “watchdogs”; thus threatening our ability to communicate unconstrained on blogs, websites, and social media platforms. A frightening charge indeed but the Commission’s Report on this issue begins on page 345 of the Report in the Digital Trade and Computer Services section and on page 346 the Report states that “the e-commerce provisions will therefore likely have a positive economic impact on a wide array of U.S. businesses, from large multinational corporations to SMEs (Small and medium-sized enterprises), and across a broad range of U.S. economic sectors”. So you could ask “who do you believe”, the extensive study by the Commission, or overreaching assumptions founded upon vague suppositions.

Further, as noted above the provisions deliberately exclude China. Several “Political Statesman” among others insist this will invite retaliation from China, an economic world power in their own right. Bottom line: Practically any participant in the Agreement will agree that China will in time join the TPP, especially if it becomes beneficial.

There are more than a few reasons to support the TPP despite globalization concerns, the following are but a few:

First, the TPP — “which seeks to govern exchange of not only traditional goods and services, but also intellectual property and foreign investment” — would encourage trade in “knowledge-intensive” services and yep, U.S. companies exert a strong comparative edge in this particular field.

Second, killing the TPP would do little to bring factory work back the US, regardless of what “the Donald” and Hillary says—“what’s gone is gone”.

Third, and perhaps most important, although China is not currently part of the TPP, enacting the agreement is sure to increase regulatory rules and criteria for several of China’s key trading partners. Thus, China will be pressured to meet some of those higher standards too.

Escalating global trade has reshaped manufacturing—admittedly forcing business, workers, and entire counties to endure painful adjustments. However, as much as we might like to return to the 1970's when manufacturing encompassed a quarter of U.S. nonfarm employment . . . that is now practicality an impossible task, absent massive protectionist barriers that would isolate the U.S. economy and lower U.S. living standards dramatically.

Blocking the TPP because of what may seem to be justified unhappiness over manufacturing’s lost “glory days” would amount to refighting another trade war. At the end of the day, a responsible trade agenda like TPP will instead allow American companies to excel in the areas where they are strongest.

Blocking the TPP because of what may seem to be justified unhappiness over manufacturing’s lost “glory days” would amount to refighting another trade war. At the end of the day, a responsible trade agenda like TPP will instead allow American companies to excel in the areas where they are strongest.

Sources:

No comments:

Post a Comment